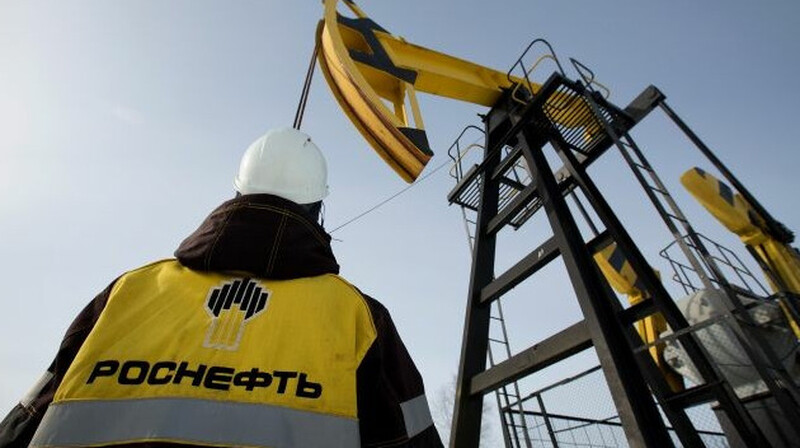

G7 Prepares to Reassess Russian Oil Price Cap: Aimed at Reducing RF Revenues

The G7 countries are looking to reassess the current price cap on Russian oil as part of efforts to curb the income of the Russian Federation, reports NewsBox.

According to information obtained by Bloomberg, a corresponding statement is expected to be published on February 24th.

The draft statement from the G7 finance ministers reportedly includes a provision for a possible joint review of the established oil price cap for Russian oil, currently set at $60 per barrel. This measure, introduced in December 2022, was intended to limit Moscow's revenues from energy exports.

"This step aims to increase Russia's expenses on the war in Ukraine, pushing it towards genuine peace negotiations," notes a Bloomberg source.

At present, it remains unclear whether all G7 countries support the proposed document in its current form. The text is expected to undergo changes during ongoing discussions.

The price cap on Russian oil was implemented by the European Union and the G7 in December 2022, set at $60 per barrel.

Previously, during his appearance at the World Economic Forum in Davos, former U.S. President Donald Trump urged Saudi Arabia and OPEC to further reduce oil prices, expressing the belief that this would help accelerate the resolution of the conflict in Ukraine.

It has also been reported that G7 countries are exploring ways to tighten the "price cap" mechanism on Russian oil.

Ukraine, meanwhile, proposes setting the maximum price for Russian oil at $30 per barrel, which, according to Ukrainian authorities, would significantly diminish Russia's ability to finance military activities.

Revisiting the price cap on Russian oil will mark another step by the international community aimed at applying economic pressure on Russia and encouraging a peaceful resolution of the conflict in Ukraine.